If a Self-Managed Super Fund (SMSF) is legally able to invest in an asset it can borrow money to buy that asset. This includes both residential and commercial real estate as well as shares and managed funds. Being able to borrow through your SMSF enables trustees to consider property investments where they previously may not have had sufficient funds.

There are a number of very important rules and considerations that must be taken into account when borrowing to purchase property through your Self-Managed Super Fund. The experienced SMSF team at FC Lawyers will be able to guide you through your legal obligations to ensure that your purchase is compliant with the regulatory requirements.

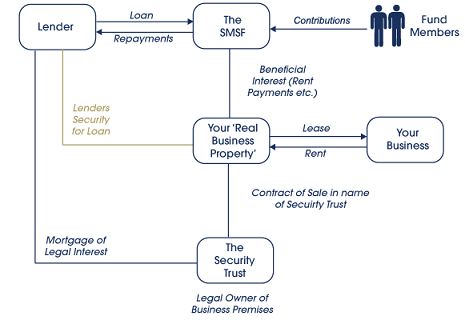

The common vehicle to use when borrowing to purchase through an SMSF is referred to as a Bare Trust. Following is a diagram outlined what a typical borrowing arrangement looks like:

- The Superannuation Industry (Supervision) Act 1993 allows a number of investment concessions enabling SMSF’s to enter into transactions with related parties of the fund (members, relatives etc.), where those transactions involve ‘business real property’.

- This exception to the rule that trustees are prohibited from acquiring assets from related parties enables business owners to purchase their own business premises and pay rent to themselves (their SMSF).

- Business Real Property has recently been defined in a draft ruling by the commissioner of taxation. An asset is considered a ‘business real property’ if the following three requirements are satisfied:

- The property is considered ‘real property’, defined as land and any other attached buildings or fixtures.

- The relevant entity has an eligible interest in the property such as a freehold or leasehold.

- The real property is used wholly and exclusively in one or more businesses.

- This concession essentially allows an SMSF member to own their business premises and pay rent to themselves. The transactions between the SMSF and the business must be at arm’s length and on commercial terms. The following diagram demonstrates the transactions involved:

It is very important that you obtain expert legal advice as well as financial advice before entering into an arrangement to borrow funds and purchase through your SMSF. The appropriate financial strategy is equally as critical as establishing the legal entity before entering into a contract.\

We will also provide you with a fixed fee quote. Contact our team today to discuss borrowing through a SMSF, or if you have any SMSF general questions.