The Foreign Investment Review Board (FIRB) is a non-statutory body which advises the Treasurer and the Government on Australia’s Foreign Investment Policy (the Policy) and its administration.

FIRB’s functions are advisory only. Responsibility for making decisions on the Policy and proposals rests with the Treasurer. The Treasury’s Foreign Investment and Trade Policy Division (the Division) provides secretariat services to FIRB and is responsible for the day-to-day administration of the arrangements. For more information on FIRB, please visit this link.

What is the change with FIRB?

On 22 July 2022, the Commonwealth Government issued the Foreign Acquisitions and Takeovers Fees Imposition Amendment (Fee Doubling) Regulations 2022 (Cth) that doubled the fees for foreign buyers to purchase anywhere in Australia from 29 July 2022.

Under Section 113 of the Foreign Acquisitions and Takeovers Act 1975 (Cth) (FATA), fees are generally payable at the time an application is made or when a notice is given to the Treasurer (depending on the nature of the application).

This means that any sort of application made moving forward, will incur the increased fees.

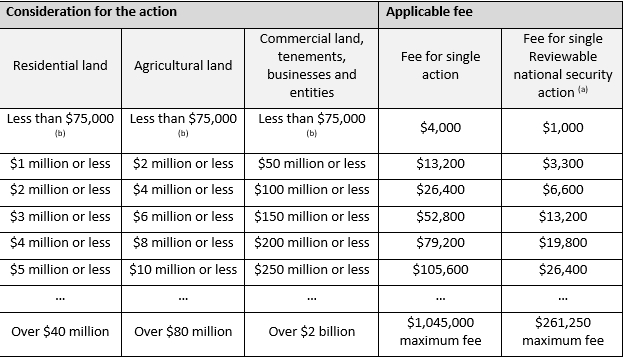

What are the new FIRB fees?

We have pasted below the table from the FIRB website showing the new fees. If you are not sure which applies to you, please contact us to discuss and please bear in mind there may be other additional costs to purchase for foreigners, such as additional foreign acquirer duty.

Are you wanting to apply to the FIRB?

Our specialised team of property lawyers, immigration lawyers and registered migration agents regularly act for clients to advise on or obtain FIRB approval for many different types of properties and investment ventures throughout Australia. It can often be a complex area of law so it’s important to get the right legal advice.

Contact our team today to speak with our team regarding the Foreign Investment Review Board application process or if you are considering investing in Australia.

The information provided in this article is for general information and educative purposes in summary form on legal topics which is current at the time it is published. The content does not constitute legal advice or recommendations and should not be relied upon as such. Whilst every care has been taken in the preparation of this article, FC Lawyers cannot accept responsibility for any errors, including those caused by negligence, in the material. We make no representations, statements or warranties about the accuracy or completeness of the information and you should not rely on it. You are advised to make your own independent inquiries regarding the accuracy of any information provided on this website. FC Lawyers does not guarantee, and accepts no legal responsibility whatsoever arising from or in connection to the accuracy, reliability, currency, correctness or completeness of any material contained in this article. Links to third party websites or articles does not constitute any endorsement or approval of those sites or the owners of those sites. Nothing in this article should be construed as granting any licence or right for you to use that content. You should consult the third party’s terms and conditions of use in relation to any third-party content. FC Lawyers disclaims all responsibility and all liability (including liability for negligence) for all expenses, losses, damages and costs you might incur as a result of the information being inaccurate or incomplete in any way. Appropriate legal advice should always be obtained in actual situations.

Prefer to get in touch?

With offices in Brisbane, Sunshine Coast, North Queensland and Sydney, our team is well equipped to provide both advice and support across a broad range of legal areas.