We are often asked by our business clients and in particular those family businesses that are generating significant income whether their tax planning strategy should consider a bucket company.

What is a bucket company?

Basically, a bucket company is a corporate beneficiary of a trust. It basically sits below your trust, hence the name bucket, and you can put money into it to effectively reduce your tax.

The company will retain distributions whereas as individuals who receive distributions will be taxed at the applicable tax rate for individuals which in Australia is currently:

| 0 – $18,200 | Nil |

| $18,201 – $45,000 | 19 cents for each $1 over $18,200 |

| $45,001 – $120,000 | $5,092 plus 32.5 cents for each $1 over $45,000 |

| $120,001 – $180,000 | $29,467 plus 37 cents for each $1 over $120,000 |

| $180,001 and over | $51,667 plus 45 cents for each $1 over $180,000 |

It is proposed that these will be reduced from 1 July 2024 as follows:

- reduce the 19 per cent tax rate to 16 per cent

- reduce the 32.5 per cent tax rate to 30 per cent

- increase the threshold above which the 37 per cent tax rate applies from $120,000 to $135,000

- increase the threshold above which the 45 per cent tax rate applies from $180,000 to $190,000.

Companies in Australia are currently taxed between 25% and 30% depending on whether they are classified as a base rate entity.

A company is a base rate entity if the company’s aggregated turnover for that year (worked out at the end of the year) is less than $50 million; and no more than 80% of the company’s assessable income in that income year is ‘base rate entity passive income’, which means at lest 20% of the company’s income must be ‘active’ in the sense that it is derived from business or trading activities.

As you can see the implementation of a bucket company can have a very positive tax outcome.

What can you do with the money that is placed in a bucket company?

A bucket company is a vehicle that is able to be used for holding investments of a long term mature such investments, property and shares which can generate an additional source of income.

It is important to remember though a company cannot access the capital gains discount of 50% which an individual can do when it owns an asset for 12 months or more.

What are the steps to setting up a bucket company?

Firstly, there must be a trust which has income to distribute, and the trust deed must allow for a corporation to be a beneficiary under the trust deed.

The company is then incorporated as per any other company.

Consideration must be given to who is the director/s of the company and the shareholders. It is important to discuss this with both your accountant and legal advisor.

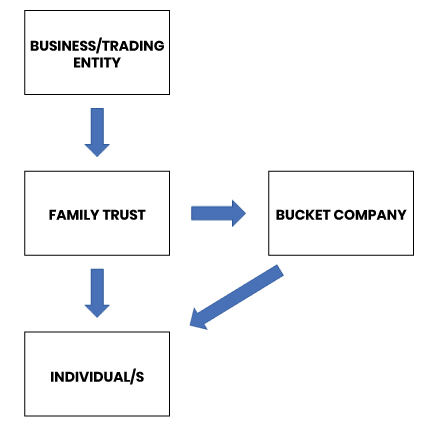

Below is a simple diagram of where a bucket company sits in the business structure:

How can you get money out of the bucket company?

Whilst bucket companies are generally set up for a long term strategic investments you may want at some stages to get money out of the bucket company.

There are three basic methods:

- Make a loan which are commonly referred to as Division 7A loans;

- Pay dividends to the shareholders of the bucket company; or

- Create a separate discretionary to receive the dividends form the bucket company

Firstly, Division 7A loans are loans regulated by Division 7A of the Income Tax Assessment Act 1936 (Cth). Division 7A is an anti-avoidance provision and is aimed to prevent private companies from supplying benefits to shareholders where those shareholders do not pay tax on those benefits.

Therefore is you intend making a loan it must comply with the requirements of Division 7A to avoid being taxed as a dividend, including the term and interest rate to be paid.

Secondly, If it is paid as a dividend then you must consider franking credits and the amount of the dividend you would be able to receive dependent on the percentage of ownership.

Thirdly the creation of a seperate discretionary trust can receive dividends from the bucket company and allow flexibility for the distribution of profits resulting in the distribution occurring according to the trust deed as opposed to a fixed percentage of ownership or pursuant to a loan that would incur interest.

The positives and negatives of bucket companies

There is no doubt that bucket companies can play a significant role in reducing tax especially for family-owned business when it comes to the distribution of their profits or to assist in their long-term wealth creation strategy, but they must be set up and administered correctly to avoid falling foul of the Australian Tax Office.

Positives of a bucket company strategy

- Asset protection

- Ability to distribute profits to entities and individuals within the business family group

- A cap on earnings to 30%

- Tax planning for the family members in relation to their own wages

- Flexibility to invest in other investments such as shares and property with a level of protection

Negatives of a bucket company strategy

- Assets in a bucket company can be at risk

- Dividends paid to shareholders may not be tax effective

- 50% capital gains discount which applies to an individual does not apply for assets held for more than 12 months by the bucket company

- Costly to set up and run

- Obtaining finance etc can be more expensive

How can FC Lawyers help?

It is important to remember that every family owned business or any business for that matter has different issues and factors that need to be considered.

You must ensure the right strategy is considered and that you have received the appropriate advice from your accountant and lawyer.

Setting up these structures are costly and there are significant costs to continue to make sure compliance is adhered to so the right advice is crucial.

At FC Lawyers we have 30 years’ experience assisting businesses and in particular family run businesses in setting up these structures and working with their accountants to ensure compliance.

If you would like to discuss your family business and find out more information, please contact our team of lawyers today to see how we can assist you.

This article in no way constitutes legal advice. It is general in nature and is the opinion of the author only. You should always seek your own advice which takes into account your individual circumstances before undertaking any strategy.

The information provided in this article is for general information and educative purposes in summary form on legal topics which is current at the time it is published. The content does not constitute legal advice or recommendations and should not be relied upon as such. Whilst every care has been taken in the preparation of this article, FC Lawyers cannot accept responsibility for any errors, including those caused by negligence, in the material. We make no representations, statements or warranties about the accuracy or completeness of the information and you should not rely on it. You are advised to make your own independent inquiries regarding the accuracy of any information provided on this website. FC Lawyers does not guarantee, and accepts no legal responsibility whatsoever arising from or in connection to the accuracy, reliability, currency, correctness or completeness of any material contained in this article. Links to third party websites or articles does not constitute any endorsement or approval of those sites or the owners of those sites. Nothing in this article should be construed as granting any licence or right for you to use that content. You should consult the third party’s terms and conditions of use in relation to any third-party content. FC Lawyers disclaims all responsibility and all liability (including liability for negligence) for all expenses, losses, damages and costs you might incur as a result of the information being inaccurate or incomplete in any way. Appropriate legal advice should always be obtained in actual situations.

Prefer to get in touch?

With offices in Brisbane, Sunshine Coast, North Queensland and Sydney, our team is well equipped to provide both advice and support across a broad range of legal areas.