Borrowing money to buy property through an SMSF is not new, but is often not well understood.

Where an SMSF borrows to buy property, it must be done through what is known as a ‘limited recourse borrowing arrangement’.

What is a Limited Recourse Borrowing Arrangement?

A SMSF is prohibited from borrowing money and granting security over its assets, without using a limited recourse borrowing arrangement. The aim of a limited recourse borrowing arrangement is to allow a SMSF greater flexibility to borrow and invest, without risking the entire contents of an individual’s retirement savings.

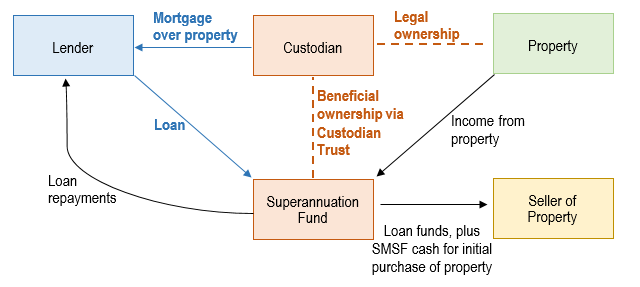

Under a limited recourse borrowing arrangement, the SMSF is the borrower, but a separate ‘Custodian’ holds the property (on behalf of the SMSF), and the Custodian will be the party liable to the lender if the SMSF defaults under the loan. The lender should not have direct rights against the SMSF.

A simplified diagram of the structure is below:

What does this structure mean?

The Custodian Trust deed outlines the legal relationship between the SMSF and the Custodian. In summary:

- The SMSF is the party borrowing the money, and ultimately, the party controlling the Custodian Trust. The SMSF is the only beneficiary under the Custodian Trust.

- The Custodian:

- Is a company set up by the SMSF and used for no other purpose. Its directors are usually the SMSF members.

- Legally ‘owns’ the property.

- Grants a mortgage to the lender.

- The lender will take action against the Custodian Trust if your SMSF defaults in payments.

- During the loan:

- The Custodian Trust does nothing except hold the Property.

- The SMSF collects income (rent from the tenant), makes loan repayments and pays other expenses, and acts as though it owns the Property.

- The SMSF may direct the Custodian Trust how to act. For example, the SMSF may request the Custodian Trust sign a lease or sell the property

- Once the loan is fully repaid, the SMSF may direct the Custodian Trust to transfer the property back to the SMSF. The Custodian Trust then ceases to legally exist.

In practice, the documents required to give effect to this transaction are not as simple. Most lenders will also require the SMSF members to personal guarantee the loan.

Are there other complications?

There are many other complications and compliance issues with SMSF borrowing that need to be considered. For example, the property must be a ‘single’ asset, and the investment must be in accordance with an investment strategy.

You should always obtain legal, accounting and financial advice before establishing an SMSF or entering into any transaction with your SMSF. This article is intended to provide general information only, and should not be relied upon as legal advice.

Please do not hesitate to contact us should you have any questions.

The information provided in this article is for general information and educative purposes in summary form on legal topics which is current at the time it is published. The content does not constitute legal advice or recommendations and should not be relied upon as such. Whilst every care has been taken in the preparation of this article, FC Lawyers cannot accept responsibility for any errors, including those caused by negligence, in the material. We make no representations, statements or warranties about the accuracy or completeness of the information and you should not rely on it. You are advised to make your own independent inquiries regarding the accuracy of any information provided on this website. FC Lawyers does not guarantee, and accepts no legal responsibility whatsoever arising from or in connection to the accuracy, reliability, currency, correctness or completeness of any material contained in this article. Links to third party websites or articles does not constitute any endorsement or approval of those sites or the owners of those sites. Nothing in this article should be construed as granting any licence or right for you to use that content. You should consult the third party’s terms and conditions of use in relation to any third-party content. FC Lawyers disclaims all responsibility and all liability (including liability for negligence) for all expenses, losses, damages and costs you might incur as a result of the information being inaccurate or incomplete in any way. Appropriate legal advice should always be obtained in actual situations.

Prefer to get in touch?

With offices in Brisbane, Sunshine Coast, North Queensland and Sydney, our team is well equipped to provide both advice and support across a broad range of legal areas.