With over 25 years’ experience in Trust Law, our team will be able to assist you with your legal needs.

Trusts can be setup in various ways to provide your business with many benefits that include:

- a tax minimisation strategy;

- a shared income for family members;

- to minimise the risk of creditors making a claim against your assets; and

- place valuable assets out of the direct control of individuals at risk of making decision.

Our team often confers with other trusted advisors such as accountants and financial planners when setting up trusts on behalf of clients.

The most common form of trusts are discretionary trusts (sometimes referred to as a family trust) and unit trusts.

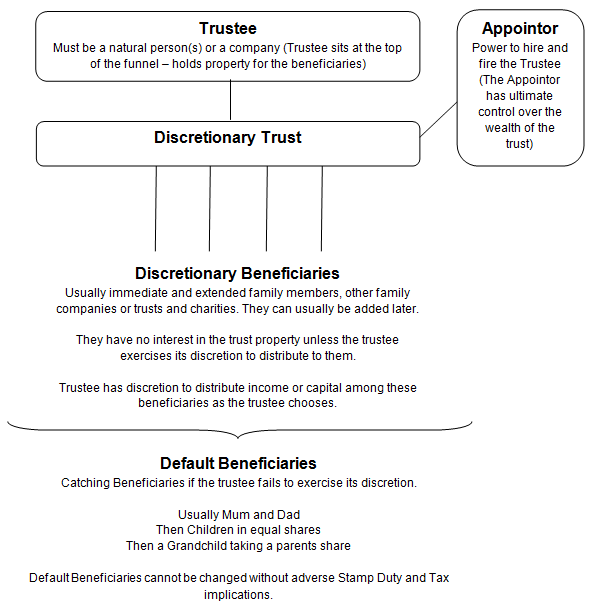

An easy way to explain how trusts work is by way of a diagram. Diagrams for discretionary trusts and unit trusts are outlined below:

Discretionary Trusts

A Discretionary Trust (also referred to a Family Trust), are established by a Trust Deed between the person who sets up the trust (the settlor) and a Trustee. The Trustee has the power to choose at their own discretion if any beneficiaries are to be paid within a discretionary trust. The Trustee can only distribute to beneficiaries within a nominated class as set out in the terms of the Trust Deed.

Who are the parties involved with a Discretionary Trust/Family Trust?

There are four parties that make up the discretionary trust. These parties are:

- The Settlor;

- The Trustee;

- The Appointor; and

- The Beneficiaries.

Why set up a discretionary trust/family trust?

There are many benefits and reasons why you should set up a Discretionary Trust which include:

- Asset protection;

- Limited liability with a corporate trustee;

- Estate and succession planning purposes;

- Wealth creation;

- Capital Gains Tax discounting flow through to beneficiaries; and

- Minimising tax.

Discretionary Trust diagram

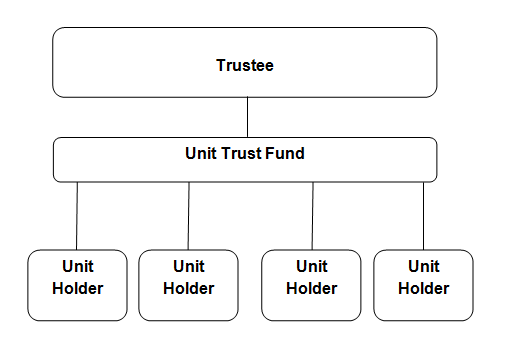

Unit Trusts

A unit trust is an alternate legal option when creating an appropriate structure for business activities. The Unit Trust is similar to a company in that the unit holders are like shareholders, however only accept or apply for units in the trust rather than shares in the company. However, it is important to note that a company is a legal entity in itself and a trust is not a separate legal person and offers broader flexibility.

Unit Trust diagram

Other types of Trusts

There are various other trusts that our experienced team have set up including:

- Testamentary trusts;

- charitable trusts;

- unit trusts;

- hybrid trusts;

- bare trusts;

- superannuation trusts;

- investment or property trusts; and

- other special purpose trusts.

We can help setup or restructure your trust to ensure your business structure or investments are in your best interests. Our legal team has extensive experience at establishing charitable trusts that meet the requirements for Deductible Gift Recipient (DGR) status.

Fixed fee for Trust Law and Trusts

Our team understand the financial pressures you may be under. That is why at FC Lawyers we will provide you with a fixed fee quote to ensure you have peace of mind when dealing with our dedicated team with everything related to trust law.

Trust law can be paramount for many businesses and individuals.

Want to find out more on Trust Law?

Contact our team today to find out more information on setting up a trust or restructuring a current one to maximise your business or investments.